Asset Management

Lifsverk's asset management is responsible for day to day management of the funds assets. Its most important role is to keep risk and return at a balance, so that Lifsverk is able to honour all its future obligations, with minimal risk.

The team has an average experience of 16 years in the financial markets.

Lifsverk's asset management is responsible for day to day management of the funds assets. Its most important role is to keep risk and return at a balance, so that Lifsverk is able to honour all its future obligations, with minimal risk.

The team has an average experience of 16 years in the financial markets.

|

Guðrún Inga Ingólfsdóttir |

Anna María Ágústsdóttir |

|

|

Eymundur Freyr Þórarinsson |

Lífsverk's Policy on Responsible Investments

March 2021

1. Purpose

Responsible investments involve applying other methods than those that only maximize financial gains. The responsible investment policy is a way to incorporate environmental, social and governance (ESG) factors, as well as active ownership, in the investment decision process. Lífsverk sees this practice as a key factor in reducing risk and increasing long-term returns on investments.

In 2016, Icelandic laws on mandatory insurance and pension rights (Section 36. 129/1997) were amended so that each pension fund is obligated to set ethical standards in its investment policy. The amended law came into effect on July 1st, 2017. By creating and implementing this policy, Lífsverk has now fulfilled this obligation and also stated its will and ambition to be a responsible investor.

Responsible investments enhance society's welfare and Lífsverk wants to take a leading role.

2. Goals and emphasis

Lífsverk's objective is to collect and manage pension contributions and invest responsibly to benefit its members upon retirement. The board is responsible for implementing an annual investment policy2 and to clarify how the fund can achieve this objective, considering the balance of risk and return on investments.

Alongside the investment policy the board sets forth this responsible investments policy. The investment policy fulfils the fund's legal duty to diversify financial risk, but this policy on responsible investments sets in addition ethical restraints on its current and future investments. The board's view is that financial and responsible objectives go hand in hand, and both benefit Lífsverk's fund members.

To reach those goals, Lífsverk has signed an agreement with UN PRI (United Nations Principles for Responsible Investments) and is thereby committed to comply with its six principles:

- 1. We will incorporate ESG issues into investment analysis and decision-making processes.

- 2. We will be active owners and incorporate ESG issues into our ownership policies and practices.

- 3. We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- 4. We will promote acceptance and implementation of the Principles within the investment industry.

- 5. We will work together to enhance our effectiveness in implementing the Principles.

- 6. We will each report on our activities and progress towards implementing the Principles.

These Principles are the foundation for Lífsverk's methodology to incorporate ESG into the investment decision making process.

Information and education on the methodology of responsible investments is crucial and Lífsverk's objective is to be an active participant. Lífsverk is among the founders of IcelandSIF – an Icelandic organization for promoting responsible investments by education and training. Lífsverk's employees are active within IcelandSIF.

Lífsverk pays attention to its members' views and opinions on responsible investments and encourages them to take part in improving their pension fund. The fund's website will be updated to allow members to participate in the implantation process by submitting their comments and ideas.

3. Sustainability

In 2015, the UN established the Sustainable Development Goals (SDGs). All member states of the UN have committed to the goals, including Iceland. The goals are a call to action to enhance the quality of life on earth.

Lífsverk will do its part in working towards sustainability and enhanced quality of life before 2030. We believe the fund to be in a position to influence most of the goals, but especially goals 5, 7, 8, 9 and 13. Lífsverk's investment strategy will thus be shaped by them.

In 2021, the responsible investment focus will reflect goals 8 and 9. Goal 8 centres on decent work and economic growth. To establish sustainable economic growth, societies need to enable the creation of decent jobs for its inhabitants. Prolonged economic growth can fuel innovation and progress, creating jobs for all and enhance quality of life. By investing in projects adhering to this goal, the fund is able to take part in building infrastructure, creating more jobs and securing equal opportunities for workers and worker rights. Goal 9 covers infrastructure, sustainable industry and innovation, so the two goals go hand in hand.

4. Lífsverk's methodology in incorporating ESG into the investment process

Lífsverk's methodology is fourfold:

- 1. Investment process

- 2. Integration

- 3. Reporting and transparency

- 4. Shareholder policy

4.1 Investment process

- Lífsverk expects both companies and fund managers to meet certain responsibility requirements.

When vetting new investment options, Lífsverk excludes certain asset classes. The reason Lífsverk finds it necessary to exclude certain types of investments is, among other reasons, that they contradict the UN goals for sustainable development. That in and of itself excludes investments in the following asset classes: - Manufacturers of controversial weapons - This refers to manufacturers of weapons that could impact the lives and health of civilians in a major way, even long after conflict is resolved. These weapons include, but are not limited to, landmines, cluster bombs, all kinds of chemical weapons such as nuclear and biological weapons, and other weapons that violate the terms of international weapons treaties.

- Companies that build their business on tobacco manufacturing

- Companies that don't respect human rights - This refers to basic human rights as defined in the Universal Declaration of Human Rights, adopted by the UN in 19483. Moreover, the adaptation for children and the goals of sustainable development come into effect during the decision-making process.

- Companies that act irresponsibly with respect to the environment - This refers to any activities that bring or can bring about irreversible damage to the earth's ecosystem, on land or sea, or activities that reduce diversity or centre on unsustainable usage of natural resources.

This exclusion means Lífsverk will not invest directly in projects, companies, entities or publishers that fall under the operations named on this exclusion list. Lífsverk aims not to invest in funds that invest in operations in the exclusion list or which portfolios are made up of more than 5% of combined investments in such operations.

Lífsverk does not invest in projects or entrust its funds to third parties who don't have a responsibility policy or that do not plan to implement such a policy in the immediate future. An exception is made for companies, projects, entities or publishers whose only operation is to invest in other companies, as long as the companies themselves have a responsibility policy. Furthermore, an exception is made for companies, projects, entities or publishers if their only purpose is specific operations that meet all other requirements listed in this policy.

The asset management team at Lífsverk will do a due-diligence assessment on every investment opportunity based on responsibility and Lífsverk's policy. At a minimum, Lífsverk will base its assessment on the questionnaire in Appendix I. The questionnaire is based on the UN SDGs Lífsverk emphasises, as well as the exclusion list.

4.2 Follow-up

Lífsverk uses two kinds of criteria for monitoring responsibility. On the one hand, internal risk analysis for the whole of the portfolio and on the other, an external risk analysis that only applies to foreign assets. The reason for these two approaches is that currently, no integrated criteria exist for domestic assets and foreign assets. However, the criteria used to evaluate foreign assets are more detailed and generate a more thorough evaluation. Each approach is important, but both have pros and cons.

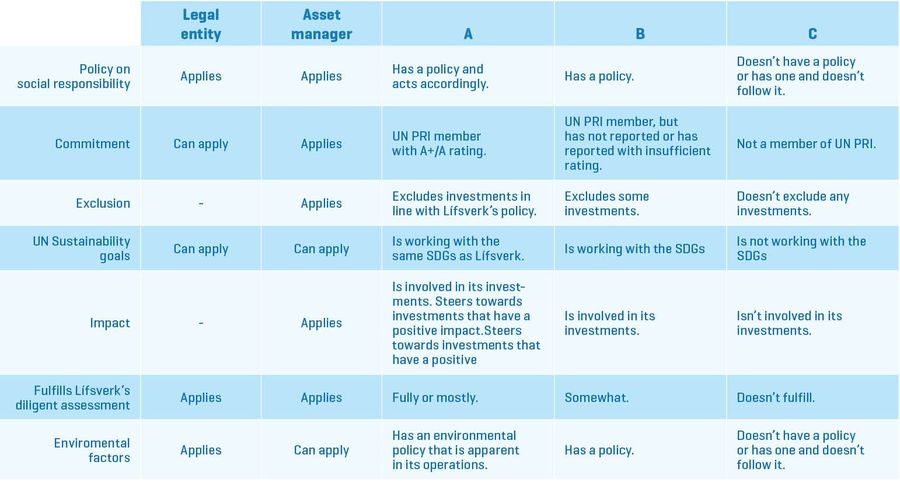

When performing internal risk analysis, Lífsverk's employees categorise all investments. In that way, it is possible to monitor all requirements the fund uses to evaluate investments and enables the fund to calculate the benefits of adhering to its policy. Lífsverk's assets are classified as A, B or C following internal risk analysis, according to the table below::

Investments are then categorised by frequency in each category. The fund's aim is to improve the proportion of assets that fall under category A each year, and that over 50% of Lífsverk's assets will reflect the fund's approach in responsible investments before end of year 2021.

External risk analysis only applies to foreign assets. In most cases, regulators monitor those more carefully and the obtained information is more accurate than those available directly to Lífsverk. Third parties perform external risk analyses for our foreign assets and grade them in a way that makes comparison to the MSCI World Index possible.

Lífsverk's aim in 2021 is to have a better score than the MSCI index in ESG factors within the measurable part of the portfolio.

4.3 Reporting and transparency

As a member of the UN PRI, Lífsverk publishes an annual report in accordance with UN PRI 6. Each year, the fund aims to address comments and remarks and improve its overall standing. This, among other things, is the purpose of this policy. Lífsverk's Chief Marketing Officer (CMO) is responsible for the UN PRI report.

At the end of each calendar year, Lífsverk submits a report to its board that highlights how the fund has reached its goals. The report is then made accessible on the fund's website.

Lífsverk monitors policy deviations, the nature of the deviation and how Lífsverk reacted.

The asset management team works to adhere to the fund's policy for responsible investments in cooperation with the CEO and the CMO.

4.4 Active ownership

Lífsverk also aims at better governance and increased transparency. Lífsverk will advocate for companies that do not or cannot evaluate ESG factors will do so.

The fund's board has set an active ownership policy for the fund, accessible on the fund's website. The aim is to integrate the active ownership policy and responsible investments policy in 2021.

5. Goals in responsible operations and environment

Lífsverk's internal goals include management, human resources and the environment. Lífsverk emphasises on environmental issues in its operations. All waste is sorted and disposed of responsibly. If possible, digital communication is used instead of printed. Lífsverk's annual report is published digitally on the fund's website, instead of on paper. Presentations on paper are not accepted and all parties are advised to share digital copies instead. The principal rule is to minimise waste in the workplace by adhering to eco-friendly purchasing guidelines and making an effort to reduce the use of single-use containers and utilities.

Lífsverk offsets the carbon footprint of all long-distance trips made by employees.

Lífsverk encourages its employees to maintain a healthy lifestyle, subsidises sports activities, and offers annual medical check-ups. Lífsverk also encourages staff to take an active part in charities in the local community.

6. Reporting and revisions of the policy

The board will annually survey and revise this policy on responsible investments. The policy will be updated accordingly on the fund's website. The Chief Investment Officer (CIO) is responsible for revising the policy. The CEO is responsible for promoting the policy internally and aiding employees in adapting to it in their daily tasks.

The policy introduces a new methodology in Lífsverk's investments. Therefore, it is important to present it in English and make it accessible to a wider audience. The revised policy will also be published and updated in English on the fund's website.

This policy was approved by the Board of Lífsverk on March 16th, 2021.